Release

Australian avocado production 'dips' as global market 'smashes' past $30 billion mark - Rabobank - Rabobank

1 Jul 2025 10:15 AM

Australia is experiencing a dip in avocado production with the 2024/25 crop estimated to be down 15 per cent on last year, Rabobank says in a newly-released report.

But the drop in Australia’s booming ‘avo’ production is expected to be short-lived, resulting from the phenomenon of ‘alternate bearing’ where trees can produce a large crop one year followed by small or no crops the next, according to the report by the agribusiness banking specialist’s RaboResearch division.

And Australian production is forecast to rebound to record volumes – of around 170,000 metric tons – in 2025/26.

And even with the decline in this year’s production, there will still be plenty of avocados to go around, says RaboResearch analyst Anna Drake, with Australia estimated to produce 128,000 metric tons of the fruit in the 2024/25 season – which equates to close to 20 avocados per person a year.

Meanwhile the world’s appetite for avocados continues to grow at a rapid rate, with the global market ‘smashing’ the USD 20 billion (AUD 30 billion) mark for the first time.

And global avocado export volumes are expanding rapidly, the Rabobank Global Avocado Update 2025 report says.

Australia

RaboResearch analyst Anna Drake said growth in new “bearing acreage” (avocado trees coming into production) in Australia is starting to slow, with the area planted at the peak of new avocado planting in 2019 now in full production.

“New avocado planting has continued to drop off sharply,” she said. “Avocado tree planting in 2024 was at its lowest level since 1999 and down over 90 per cent from the highs in 2019, signaling the beginning of a levelling-off in crop size.”

Ms Drake said while Australian avocado production is expected to rebound next year, with many alternate-bearing trees set to have an ‘on’ production year, longer term, the production growth rate is likely to slow, reflecting a stabilisation in supply.

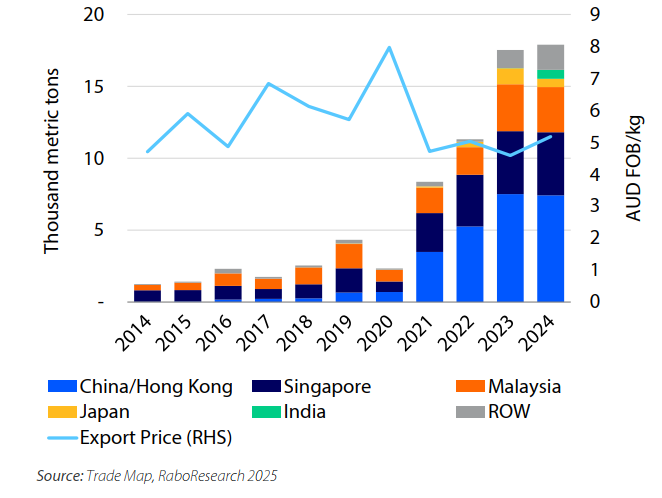

The report said while Australian avocado export volumes remained flat in 2024, export prices improved for growers, up 13 per cent year-on-year to AUD 5.18/kg.

“Export volumes to the major destinations of China, Singapore and Malaysia remained almost unchanged year-on-year, while those to India increased sharply after improvements in market access,” she said.

Ms Drake said over the past five years, Australian avocados exports had shown impressive growth, with 10 to 15 per cent of production volumes now moving into export channels.

Australian avocado exports, 2015-2024

Ms Drake said following the anticipated rebound in Australian avocado production next season, continued export growth across Australia’s key markets will be a critical factor in easing downward pressure on prices for the industry.

Global markets

The report says the global avocado market continues to grow, with an average annual market value – in terms of consumer prices – now estimated at USD 20.5 billion (more than AUD 30 billion).

RaboResearch senior horticulture analyst David Magaña said three main regions represented 88 per cent of this market value – Latin America, North America and Europe.

While Latin America leads global consumption, the market value in the rest of the world is still low (at 12 per cent), he said, presenting opportunities for growth.

North America had seen a significant increase in avocado demand growth in the past two decades, led by marketing campaigns.

Globally, avocado export volumes are growing rapidly, RaboResearch said, driven by increased production and diversification of exporting countries. “Amid this rise of new suppliers, seasonal oversupply in certain markets is a concern that will require continued demand creation and marketing strategies,” it said.

RaboResearch expects global avocado exports to continue to expand in the next few seasons.

“We estimate global avocado exports will surpass three million metric tons by 2026/27, a significant increase from one million metric tons in 2012/13,” Mr Magaña said. “This massive growth is the result of increasing exports from the current top three avocado exporters – Mexico, Peru and Colombia – accounting for about two-thirds of global exports.”

Another factor, the report says, is the continued diversification of growing regions and the appearance of new exporting countries. Attracted by high margins in recent decades, new players are producing and exporting avocados, although pressure on margins is growing, it says.

<ends>

RaboResearch Disclaimer: Please refer to Australian RaboResearch disclaimer here

Media contacts:

Denise Shaw Will Banks

Media Relations Media Relations

Rabobank Australia & New Zealand Rabobank Australia

Phone: 02 8115 2744 or 0439 603 525 Phone: 0418 216 103

Email: [email protected] Email: [email protected]

About us:

Rabobank Australia & New Zealand Group is a part of the international Rabobank Group, the world’s leading specialist in food and agribusiness banking. Rabobank has more than 125 years’ experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 38 countries, servicing the needs of more than nine million clients worldwide through a network of more than 1000 offices and branches. Rabobank Australia & New Zealand Group is one of Australasia’s leading agricultural lenders and a significant provider of business and corporate banking and financial services to the region’s food and agribusiness sector. The bank has 87 branches throughout Australia and New Zealand.

Anna Drake.jpg

Anna Drake.jpg